But one revolution is missing – sustained interest rate rises, an environment which almost no one working today has previously experienced, particularly in the investment industry.

Last time we said “rising inflation can act as the useful idiot for them to raise interest rates”.

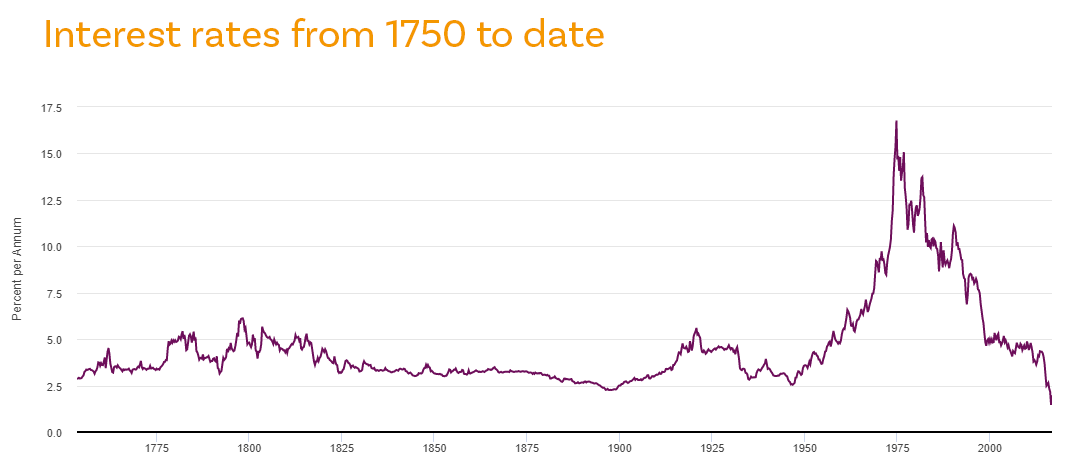

The “them” is the central bankers, who have procrastinated for more than a decade to raise interest rates, which were kept at 300 year lows for an emergency which ended over a decade ago.

Having waited years for interest rates to go up, nerves are jangling, to put it mildly. There is no easy way out of the hole which has been dug by central banks and governments.

The UK, among others, has raised rates modestly. The US is talking about raising rates from March. The European Central Bank is dithering. Russian sabre-rattling does not help the already ponderous Euro-thinking, with risks of an inflation spike, war, and power cuts.

In most financial markets the pandemic is no longer considered a significant risk – though new variants remain an unknown factor. It is the new era for interest rates which now preoccupies the pivotal US. Their stock market peaked across New Year, and our analysis suggests this could be a very significant top, and that we are at the beginning of a sharp or prolonged downturn, perhaps both.

From an investor perspective, dexterity will certainly be needed to navigate the period ahead, which is where evolution comes in on our side of the fence. We will be introducing a discretionary investment service. This has been requested by clients for many years, and is now a necessity being driven by a broad range of unfolding events.

This will enable us to move faster in an era of greater volatility, and when many of “the norms” which have become established over the last 30-40 years will be turned on their heads.

Most investors and investment professionals and experts are not prepared for the adjustments which will be required.

In addition, no fund managers have worked in a period such as lies ahead – of rising interest rates, higher inflation, largescale disruptive technology, the unravelling of a massive debt bubble, the bursting of an investment bubble on a scale never before seen in Western economies, a rebuilding of the world to cope with climate change… the list goes on.

Whether evolution or revolution, we are still here to help you, as we have been since the 1980s. In a bizarre way we look forward to this period with some excitement.

Those of you who regularly read our TopFunds Guide will recall the section headed:

“You could be this unlucky – the accidents of history”

Though the last 40 years has been a golden age for many, this section reminds us all that the going can get very tough, as it did for many of our parents and grandparents – living through two World Wars and a depression – and the 1918 pandemic lest we forget.

The 40 years ahead will be very different to the last 40 years. The foundation for the last 40 “golden” years has been ever-reducing interest rates, which is illustrated in the graph below.

Yet, despite the US being at the epicentre of a massive and unique bubble in financial markets (whether stock market, bonds, or property), there are opportunities elsewhere – even in the UK!

We look at these opportunities in the latest TopFunds Guide, which you can order here.

Bank of England, Consol (Long-term bond) yields in the United Kingdom

Bank of England, Consol (Long-term bond) yields in the United Kingdom