Moreover, some tax experts are of the opinion that the tax screws could be further tightened in the years just ahead. As government expenditure continues to rise, at a time when the cost for the government to borrow money is also rising sharply, the obvious alternative to borrowing is for the government to raise more money through taxation.

But now let’s concentrate on what we know is changing, starting with a simple recap on when you pay CGT.

When You Are Liable to Capital Gains Tax

CGT is only paid on gains you make when you sell assets. For example, assume that your only sale in this tax year is a fund valued at £30,000, which you originally purchased for £10,000. Your gain is the difference of £20,000. Part of this gain is exempt from tax (£12,300 for this tax year), and you only pay tax on the difference, which is £7,700 (this is called the taxable gain).

The New Tax Rates

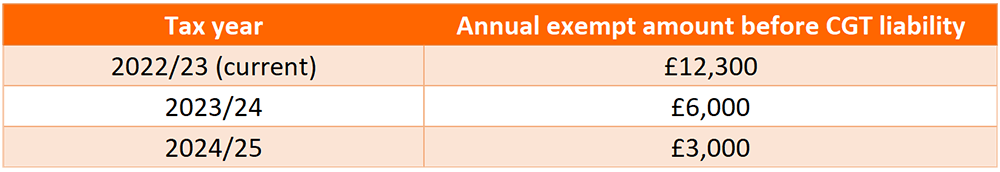

It is a change in that exempt amount which was announced in November’s Autumn Statement. You can see in the table below that this reduces from £12,300 in the current tax year, to £6,000 in the next, and £3,000 in the year after that:

The CGT rate for higher rate taxpayers is 20% (10% for basic rate taxpayers). Therefore the tax payable on that £7,700 is £1,540.

In 2023/24, with an exempt amount of just £6,000, the taxable gain goes up from £7,700 to £14,000. The tax payable is now £2,800, 82% more than if the gain was realised, and tax paid in this tax year.

If this gain was made in 2024/25 the taxable gain is then £17,000 and the tax payable is £3,400, 120% higher than if the same taxable gain was made in this tax year.

Is Capital Gain Tax Relevant To You?

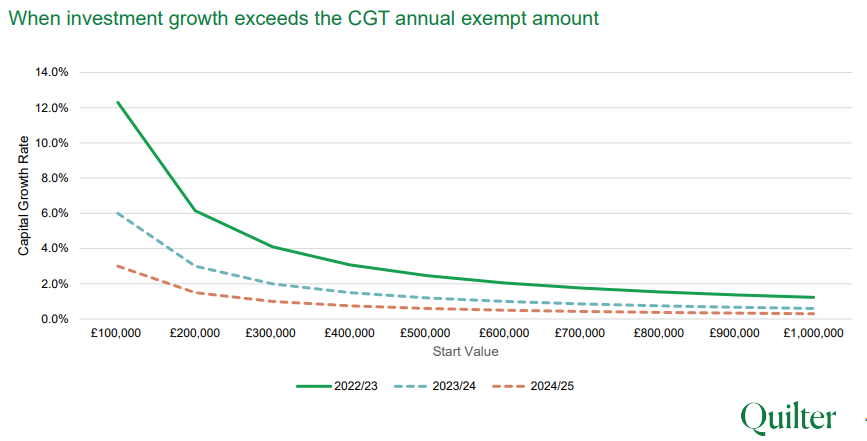

Many people are often under the impression that they don’t need to worry about CGT, and for many that’s ok because it’s been easy to stay within the tax-free threshold. However from April 2023, and even more so in 2024/25, there will be more and more people who will have to pay up. The chart below from Quilter highlights this, for example with a portfolio of £200,000 in your sole name:

- Up to this tax year, you could grow your portfolio by 6% a year and pay no CGT

- From 6th April 2023, you only need a growth rate of 3% before you pay CGT, if you realise those gains in the tax year

- From 6th April 2024, this falls to a growth rate of just 2%

Action You Should Take Now, And Other Key Points

Actions you can take immediately:

- Use your exempt gain allowance (£12,300) by 5th April 2023, before it halves…

- You cannot carry the allowance over, once it’s gone it’s gone.

- You can offset realised losses against realised gains in the same tax year.

- You can also carry forward unused losses to another tax year…

- …Losses may be carried forward indefinitely but need to be reported to HMRC within four years from the end of the tax year in which they arise.

- Maximise your ISA subscription for this tax year (£20,000), where gains within ISAs are free of CGT.

- Where you have a spouse or civil partner, transfer investments with gains to them (which you can do without paying CGT), such that the spouse or partner can sell those investments and use up this year’s exempt gain allowance, before it is cut in the next tax year.

- Similarly, transfer assets to your spouse or civil partner so that they can put an ISA in place for this tax year, and thereby shelter future gains

Specifically from 6th April:

- Use your ISA allowance early and don’t wait until the end of the 2023/24 tax year to use it!…

- …this gives you a whole year’s worth of potential CGT free growth, which you lose if you wait until the last minute.

- As above, as transfers to a spouse or civil partner are CGT free, it’s important to do this to use both of your tax-free exemptions, and also to maximise ISA contributions (£40,000 instead of £20,000).

- Where both spouses or civil partners have used their annual CGT allowance, ensure gains are realised by the individual who pays the lowest marginal rate of tax e.g. the tax rate could be 10% rather than 20%.

Do speak to your adviser to find out how any of the above could work for you in practice.

It’s also worth bearing in mind that you should still report your realised gains in your tax return, even if you do not believe tax is payable, if both of the following apply:

- The total value of sales in a tax year is more than 4 times your exempt allowance (£49,200, being 4 x £12,300, but soon to go down to £24,000)

- You’re registered for Self-Assessment

For those of you who are not registered for self-assessment but would like to check whether you need to report a gain, the gov.uk website has a useful section in its portal that allows you to do this – check here for more information.