We are always open to hearing what others have to say in our industry, especially when they disagree with our views because it makes us go back to the drawing board and ensure what we are preaching does in fact work.

We are always open to hearing what others have to say in our industry, especially when they disagree with our views because it makes us go back to the drawing board and ensure what we are preaching does in fact work.

Secondly, and perhaps of less importance than ensuring our research is water-tight, is the reconfirmation that what many in our industry write is either sales patter or defensive nonsense.

Below are some of our favourite quotes from the article, and yes, below we have actually included objective research and evidence to show how fundamentally wrong they are:

- “In fact, you are likely to lose money with Stop-Losses. They can also just as easily stop future gains, incur transaction fees, trigger taxable events and otherwise cause you to make less money than if you simply let your investments be.” – Wrong.

- “Quite simply, this is because it [momentum investing] is not an effective long-term investing strategy in our view.” – Wrong.

- “Stop-Losses can also create a false sense of security by making it seem possible to limit volatility and losses without having to closely monitor your portfolio.” – Wrong.

It is worth pointing out that we apply Stop-Losses to funds (OEICs/unit trusts) as opposed to ETFs and shares. Some of what they mention above, such as increased transaction costs, while it may be applicable for ETFs and shares, is not the case for funds.

Let’s work through these three points in a bit more detail.

Point 1:

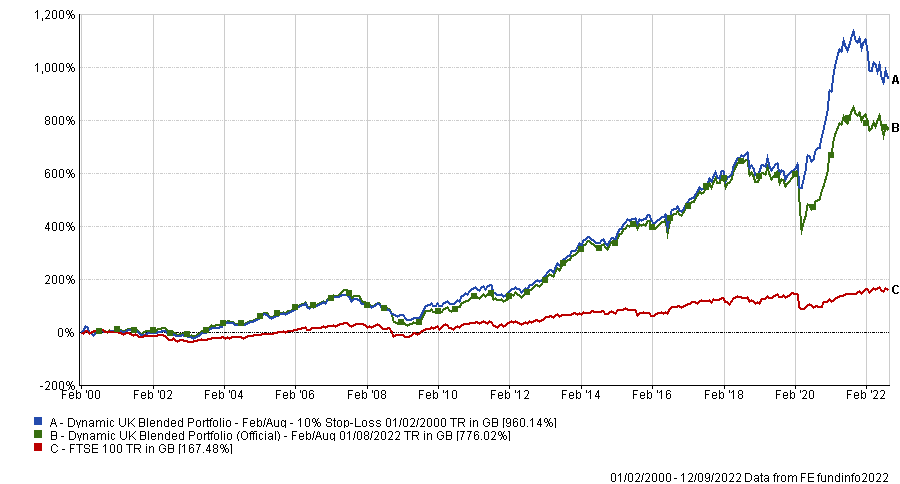

Contrary to what they say, our evidence is that you are more likely to make money from using a Stop-Loss, and we have proved this most recently in our blog from April 2022, which you can read here. For reference, the highlight of that data is below, with an updated performance chart, and risk covered under Point 3. This comprehensive data has been conducted for our most popular Dynamic Portfolio, UK Blended.

Performance – Better With A Stop-Loss

Point 2:

Contrary to what they say, momentum investing is a highly effective long-term investment strategy, and you can see how this works in multiple sectors here.

You can see the history of momentum investing in “Two Centuries Of Pedigree”, which also has a list of the decades of research conducted by third parties. There isn’t too much else to say on that, as the numbers genuinely do speak for themselves, and very loudly.

We are always very open and honest with our research, we report on every Dynamic Review, whether they have gone up 60%, or dropped 20%. We don’t hide behind false pretence, and we find lots of the drivel that is out there in the financial press does more damage than good to DIY investors.

Point 3:

Stop-Losses reduce volatility.

In terms of risk, the portfolio with Stop-Losses applied has lower worst month and worst year figures compared to the portfolio without Stop-Losses, as you can see below. This, for us, is unsurprising, and is highlighted in the table below.

| Name | 5-year Volatility | Worst Month | Worst Year |

|---|---|---|---|

| Dynamic UK Blended Portfolio 10% Stop-Loss | 14.14 | -14.34 | -22.27 |

| Dynamic UK Blended Portfolio No 10% Stop-Loss | 17.79 | -21.83 | -36.45 |

| FTSE 100 | 13.52 | -13.41 | -28.33 |

Back to the article, Fisher does offer an example of the arbitrary nature of Stop-Losses, though it is a bit contrived and misses the point:

“To illustrate the arbitrary nature of Stop-Losses, consider this scenario: Jen buys ABC stock at $50 and it rises to $100. Then Sam buys ABC at $100, and it falls to $80—a 20% drop from its high. Should they both sell at $80? Or just Sam because he has a 20% loss? Based on this scant information, there is no right answer because past price movement isn’t indicative of future price movement.”

What is the point? It is as Warren Buffett put it succinctly:

“The first rule of investing is not to lose money”

It really is that simple. A Stop-Loss is not you or I predicting where the market will go next. It is all about protecting our valuable capital. Remember “The Japan Problem”, with lots of other detail about risk in this blog, including the need to adapt.

The lesson?

If you lack a clear method for selecting your funds, as well as not having a Stop-Loss strategy in place, you must re-visit your investment plan. How does more growth and less risk sound to you? What is there not to like?

Needless to say, if you don’t have a plan, make one now. With a plan in place, it is much less likely you will make a bad decision once you come under fire – plan now and avoid unnecessary stress later.

Perhaps most importantly, please take lots of what our industry says with a pinch of salt. If you see advice by proclamation, typically on the pedestal of a big brand, ask them for the evidence (and do share our evidence with them!).

Ps – after scouring through Fisher’s website, there isn’t one performance graph or table related to their portfolio service. Though Yodelar did conduct a fairly comprehensive review of their management here if you are interested.

This blog was first written on 16th September 2022, on the research hub of our sister company FundExpert.