“Uncertainty is uncomfortable. But certainty is absurd” (Voltaire)

“Uncertainty is uncomfortable. But certainty is absurd” (Voltaire)

Aided by a crystal ball, from various points in 2021, 2022, and 2023, you could have looked forward to the beginning of December and observed that the US stock market, the world’s most important, was largely unchanged from your vantage point. But this tells you nothing of the journey between these points, marked by gut-wrenching volatility and a series of world-troubling events.

This state of affairs flummoxed most investment banks, despite being rammed full of big brains, seven figure pay packets, and immense computer power. Most expected recessions, and many would certainly not have been surprised by substantial falls in stock markets, ourselves included.

This prolonged mix of stagnation and volatility certainly made it feel like there were sustained and substantial falls. But in practice these were only encountered by those unlucky enough to be in the “safe” bonds issued by UK and US governments, both of which were down by around 50% at worst. Similarly with funds which were the pre-pandemic stars, such as Scottish Mortgage, branded to sound very sensible and staid but which fell off a cliff.

As the investment banks dusted off their crystal balls looking forward to 2024, there was a new found humility amongst some. “Too early for victory lap“ was the JP Morgan headline. In contrast, the pot boilers at Goldman Sachs insist “The hard part is over”.

The last two months of 2023 were positive to some degree, but it is very important to also look at the larger context. Starting with the former…

They Think It’s All Over…

Early in October we appeared to be on the edge of financial markets falling very sharply, with even the perpetual optimists seemingly nervous. Then in the last week of October everything seemed to change based on one month’s stats suggesting that inflation was rolling over and down. This was enough to trigger growing speculation of interest rate cuts sooner than expected.

Financial markets came back from the brink, and a new positive trend built right until the end of the year. Early in November we took advantage of this in our discretionary portfolios, and moved fast to be reasonably fully invested.

UK and US government bonds (the world’s safest asset class?) had been smashed in the previous year. Now they rejoiced at the prospect of lower inflation and interest rate cuts, more so in the UK.

It wasn’t just UK bonds which bounced. Against global peers the UK stock market also stood out, particularly the FTSE 250 index, which is more a reflection of how investors feel about the UK than the FTSE 100 index, which is dominated by large global businesses.

Happy days? Yes, in the short term and some positivity was most welcome. Nonetheless, as we peer into 2024 the vulnerability of financial markets is unchanged, confidence is thin, and there are a range of additional cross-currents, notably a collection of important elections around the globe, plus the risk of escalating wars.

Now let’s explore the larger context which feeds into this vulnerability.

Context Is Needed – The Investment Cycle

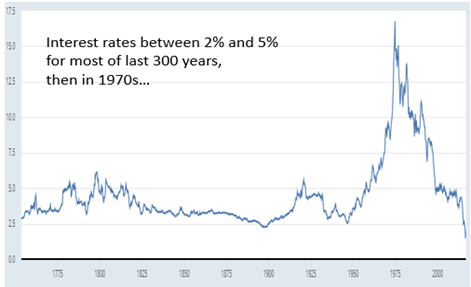

In simple terms the investment cycle is the ups and downs of the stock market over years. The dominant trend for the last 40 years has been upward, a very positive period for investing, supported by falling inflation and interest rates collapsing from 17.5% to 0%, as you can see in the chart below.

That positive cycle is now over, as we warned, from before the pandemic, that it soon would be.

Chart 1: UK Interest Rates For The Last 300 Years

Bank of England, Consol (Long-term bond) yields in the United Kingdom [LTCYUK], retrieved from FRED, Federal Reserve Bank of St. Louis; February 15, 2021

A 40-year cycle does not turn on a sixpence. Rather it is likely to roll over and down over years, on occasion frustratingly slowly, but also punctuated with rapid and sharp falls. It is this mix which we have endured in the last 3 years.

Eventually the buds of a new upward cycle will appear around the globe, and vigilance is needed to benefit from these as early as possible. It feels likely to be centred on Asia. Will it be led by Japan or India? Or possibly China, which too many dismiss at the moment. That is for the future, hopefully the near future.

Right now we are at a stage when the excesses of the old cycle will become more apparent, and we must be careful to avoid the inevitable damage from their exorcism. The greatest excesses have accumulated since 2009, when central banks began their “free money” experiment – not a gift to all of us of course, but rather to those within the banking system, both juicing their profits and encouraging the accumulation of a mountain of dodgy debt.

Much of this debt was accumulated by companies, often to fund over-ambitious expansions. Some went bust before the pandemic e.g. Jamie Oliver. Government largesse mid-pandemic provided a breathing space for other businesses, but those benefits are slowly and surely unwinding.

Surprisingly, to this point it is “safe” government debt that has taken the big hit, down 50%+ in the US and UK by last Autumn. Some commercial property values are also under considerable pressure, with much more of the same to be revealed over the next 12-24 months.

The US stock market has been the most obvious beneficiary of “free money”, with over-confidence and complacency ballooning since 2009. In Chart 2 below you can see how the journey to 0% interest rates drove the US stock market, and its valuation, to giddy heights, very similar to those of 1929 and 1999 – and we all know what followed, falls in excess of 50% over a number of years.

In Chart 2 you can clearly see the impact of the journey to zero interest rates on the upward trajectory of the US stock market since the 1970s. Some basic chart analysis highlights the potential for falls of 55-85%, where you can see the dashed red lines.

Chart 2: US Stock Market Since 1970s

Not All Bad News!

What you see in Chart 2 is an uptrending investment cycle in the US which lasted 40 years. It also gives you a sense of how steep the falls might be in the end. That is the easy bit.

The difficult bit is the shape and timing of such falls, but for history suggests the downturn will be prolonged, with the most extreme example being the Japanese stock market enduring 20 years of falling prices from 1989.

Thankfully it isn’t all about the US, and there is also good news.

A number of other stock markets are very cheap, and this creates an opportunity.

UK: Much of the UK stock market falls into this category, particularly smaller and medium-sized companies. The immediate barriers to greater enthusiasm for the UK is a looming recession and general election. We accept that what is cheap can get cheaper. That being so, the best longer-term opportunity to buy the UK might well be just after the general election – history tells us that, and we will talk about that some more nearer the event itself.

Japan: It is also extremely cheap. Better still, for very long periods it can go completely the opposite direction to the US stock market, as it did both in the 1980s (it spiked higher for a decade) and in the 1990s, when this reversed.

China: Their stock market is cheap, but not yet cheap enough to excite their domestic investors, who are key to their market recovering. Their government will take action to boost confidence, but we do not know when. We watch with interest for now.

Government bonds: Above we mentioned how UK government bonds had been smashed, down more than 50% at worst. But they have turned around and up since the end of October, and this might be the beginning of a somewhat larger recovery – you just need to be wary of any inflationary shock e.g. derived from an escalating Middle East conflict.

Commodities: Definitely interesting, with gold in the vanguard and looking set to head higher in 2024 as the investing public gets sucked in slowly but surely, as they always do with this emotional asset. Oil is difficult to fathom, with many cross-currents. In contrast, base metals are in short supply, and demand continues to grow – this is a recipe for higher prices and bigger profits from commodity companies.

Currencies: Occasionally some currencies are attractive taking a multi-year view, and the Japanese yen falls into this category.

In Summary

All of our experience and research stretching back decades gives us great confidence in what will be achieved in the years ahead. For now we seek to strike the right balance between the above opportunities and the self-evident vulnerability derived from the US bubble and a mountain of poor quality debt.

We stand ready, as events can move fast, and undoubtedly will.

P.S if you have not yet switched over to our discretionary service, the opportunities set out above are best exploited within our discretionary service. In addition, outside that service your investments might be unnecessarily exposed if events unfold rapidly. Please email to discuss.