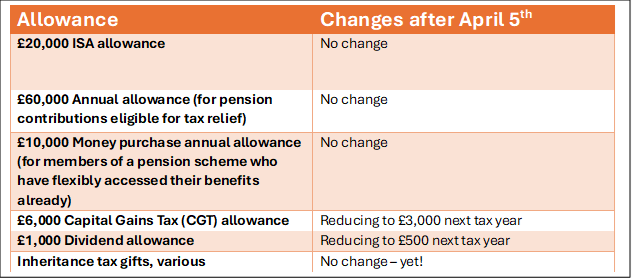

This table highlights the key allowances, and any changes to be made after April 5th.

Please also bear in mind that there could be another two Budgets this year – one from the current Government, and another from a new Government, probably Labour. So it is important that we remain vigilant during 2024.

Action To Take Immediately

The good news is you still have time to make the most of the above allowances, although don’t leave these until the last minute as all platforms have tight deadlines and cut off points.

Although there are currently no planned changes to the ISA or Annual allowances (the two most popular), with a change of Government likely by the end of 2024, it is not outlandish to suggest that these generous tax allowances could be reduced…

…So even if you have already made the most of these allowances for this tax year, it will be sensible to repeat the same steps at the beginning of the 2024/25 tax year in April.

On inheritance tax, there are a myriad of allowances of which you can take advantage. We have listed these separately here, and we will be happy to guide you, as there are various possibilities.

For example, even if you don’t make personal pension contributions, you can gift to children or grandchildren by way of a contribution into their own Junior SIPP. This is hugely tax effective, as well as a great help to the next generation of your family.

You can do similar with a Junior ISA, for children and grandchildren up to 18 years of age.

Bed & ISA

Capital gains tax is going to become an issue for many more people in the next year or two. As you can see from the above table, the CGT allowance is halving to £3,000 from April 6th, and action now is important to avoid paying tax unnecessarily.

For example, we can perform what is known as a “Bed & ISA”. A Bed & ISA is a neat way of making use of both your CGT and ISA allowances, by selling investments held outside of your ISA, and immediately purchasing them within your ISA wrapper.

In this way we not only utilise your CGT allowance (up to £6,000) but also your ISA allowance up to £20,000, without it costing you a penny.

Action now?

To make a contribution to your ISA or Self Invested Personal Pension (SIPP), or to take any of the other action outlined above, please email to discuss.

Or simply ring on the usual number, 020 8467 1666.